2024 Gartner® Magic Quadrant™ Report for Managed Network Services

Enterprises use MNS to balance expense optimization with network and security service operations quality. I&O leaders seek AI/machine learning-enabled providers to achieve shorter cycle times and higher quality services via automation. This research will help navigate the competitive MNS market.

65%

of new software-defined wide-area network (SD-WAN) purchases will be part of a single-vendor secure access service edge (SASE) offering by 2027, an increase from 20% in 2024.

20%

of initial network configuration will be accounted for by generative artificial intelligence (GenAI) technology, which is an increase from near zero in 2023.

Market Definition/Description

The managed network services (MNS) market focuses on externally provided, network operations center (NOC) functionality, as well as relevant network and security life cycle services that deliver current and emerging requirements to end users.

Gartner® defines the MNS market as globally capable providers of remote service management functions for the network and security operations of enterprise networks, including:

Managed LAN services

Managed LAN services (MNS for LAN) must include the management of enterprise LAN customer premises equipment (CPE), such as campus switches and wireless access points. It provides single point of contact (SPOC) ownership for the life cycle management of these devices. These services may include the management of customer Internet of Things/Industrial IoT (IoT/IIoT) infrastructure and endpoints. These services may include managed operations services for other elements, such on-premises servers, storage, gateways and controllers.Managed WAN services

Managed WAN services (MNS for WAN) must include the management of site edge ingress and egress CPE, and any WAN connections and service operations management. These services provide life cycle management for site edge CPE, such as routers, firewalls and software defined WAN (SD-WAN), with or without security co-residency on site edge CPE. The services must include a SPOC, ownership for the life cycle management of these devices for site edge CPE, and transport services connecting client sites to any destination. This includes hybrid cloud or other non-client-owned locations. These services may also include the operations management of enterprise customer IoT/IIoT infrastructure and endpoint management.

Managed Security

Managed security (MNS for security) functions include health, configuration and maintenance support for security technologies. Service delivery is for a single vendor to enterprise clients of multiple vendors of converged network and security function life cycle management operations. These include the support of: (1) SD-WAN-embedded security functions; (2) secure web gateways (SWGs); (3) cloud access security brokers (CASBs); (4) network access control (NAC); and (5) network firewalling, with or without intrusion prevention system/intrusion detection system (IPS/IDS). MNS for Security supports branch offices, remote workers and on-premises general internet security, private application access, and cloud service security functions for consumption use cases.

Mandatory Features

The mandatory features for this market include:

- Service delivery platform (SDP): This area is specific to the application tool infrastructure and the integration of the MNS provider’s SDP. An MNS provider’s SDP involves the integrated application architecture and the enabling technologies designed to support the standardized, high-quality and scalable delivery of managed network services to enterprise customers. The single MNS SDP supporting LAN and WAN may be separate from, but will be integrated with, a security-specific MNS SDP.

- Service management: MNS management refers to the entirety of life cycle activities — supported by tool-based workflows, automation and customer support mechanisms that are performed by MNS providers. MNS providers deliver these services with internal employee resources for all enterprise customers and industry segments.

- Operations automation: This includes the automation of tasks and activities related to the SDP, service management functions, and customer experience (CX) management to achieve consistent MNS service delivery quality.

Note: The MNS market does not include any network or security products, software, maintenance, network services, or cloud-based services or products. These elements are covered by other Gartner® research.

Common Features

The common features for this market include:

- Support for customer endpoints beyond network and security that may include physical/virtual servers, storage, power, environmental systems, physical security, operational technology (OT) and IIOT.

- Formal continual service improvement programs for MNS customers.

- Networking and security architecture design services.

- Certifications, such as ITIL v3/v4, relevant OEM vendor and System and Organization Controls (SOC) 2 certifications.

- Network and security product resale or as OEM sale offers.

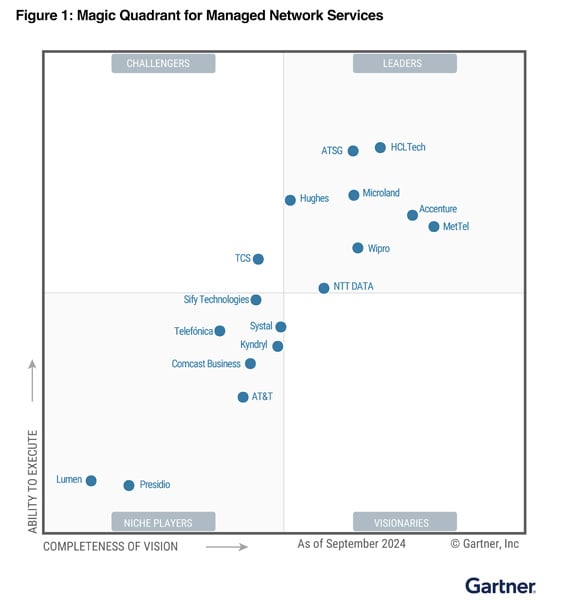

XTIUM, formerly ATSG, Recognized as a Leader in the 2024 Gartner® Magic Quadrant™ for Managed Network Services (MNS) Report for the 3rd Consecutive Year

XTIUM, formerly ATSG has, once again been recognized as a Leader in the 2024 Gartner® Magic Quadrant™ for Managed Network Services (MNS) report. This is the 3rd consecutive year that we have been recognized in the report.

We were assessed for our Completeness of Vision and Ability to Execute. We believe our recognition is bolstered by:

- Consistent innovation in the domains of managed LAN, WAN, SD-WAN, and Data Center.

- Adaptability to evolving market demands, with robust solutions for managing emerging architectures such as ZTNA, SASE, and secure Wi-Fi.

- A comprehensive approach that addresses both current and emerging managed networking needs for businesses of all sizes.

- Strong performance in customer experience and operational efficiency.

We streamline and optimize mainstream networked environments including LAN, WAN, SD-WAN, Data Center, and Wi-Fi by ensuring reliable connectivity, enhanced security, and efficient management. This is integrated with a comprehensive vision for delivering secure and scalable services for ZTNA and SASE.

Market Overview

All providers in the Magic Quadrant™ and Critical Capabilities for MNS globally support multiple LAN, WAN edge and security function vendors, servers, virtual machines, and microservices operations assurance and protection, whether focused on domain integration or work unit.

MNS are remotely delivered services from the provider’s NOC/SOC, with a separate disaster failover hot site as a minimum. The NOC personnel are commonly deployed at the physical NOC/SOC location and/or deployed regionally.

The providers in this market are traditional network service providers, SIs or pure-play MNS providers. The MNS market does not include network services (e.g., WAN transport services), or network/security products.

Three mission-critical capabilities are highly interdependent in the MNS market:

- Service delivery quality: Process efficiencies, data accuracy and integrated service management across the MNS solution.

- Network automation: High-performing FCR for automated incident resolution, leveraging AI/ML with automation orchestrations to deliver high-functioning troubleshooting automations.

- Customer experience: Near-real-time, configurable, automated updates and easily navigable portals that display key metrics performances for all services.

The MNS market is a volume operations business model, not a complex operations model that is prone to the challenges of managing high customization. Volume-based models focus on optimizing products and services in a relatively mature market (for example, LAN, WAN and security environments). Volume models deliver standardized services, undergirded by repeatable processes and tightly integrated tools with high degrees of automation, to achieve high-scale efficiencies, resulting in higher delivery quality and optimized costs. Provider differentiation comes in the form of consistently higher-performing cycle time metrics, improved service quality, and cost-effectiveness. This Magic Quadrant™ is focused on the volume operations MNS provider business model, not custom-managed NOC offers.

The MNS volume delivery model has been in place for many years. It has evolved from a complex operations delivery model, which is similar to today’s customized IT outsourcing agreement delivery models. Network and security technologies continue to evolve, and the software to manage these networks has improved substantially during the past 10 years.

However, some MNS providers are also IT outsourcers that operate both models and straddle the two markets. Specifically, MNS is highly standardized and scalable, whereas common IT outsourcing agreements are substantially customized for a specific enterprise. The customized models commonly have lower standardization for scale efficiencies, less predictable costs and more prevalence for labor-driven pricing models.

In cases where the provider’s operations delivery uses both models to serve customers, provider performance is often broadly impaired. Shared provider operations resources with high variabilities in standardization, automation and performance quality standards commonly demonstrate diminished value at a higher cost to buyers. This happens for both types of managed services in the market when providers share common resources across these two disparate delivery models, since the provider’s offerings, investments and focus collide.

The current network and security trends enabling the expansion of MNS provider support are:

- Increased AI capabilities incorporated into user experience, documentation and service queries.

- Fixed wireless access with multicarrier eSIM capability could become strong alternatives to fixed cable broadband access.

- New LEO satellite services are moving toward mainstream adoption, specifically those operating at nonlegacy altitude orbits.

- 5G private mobile network (PMN) and Wi-Fi 6 continue to gain traction. Many providers in this research support both of these technologies. Additionally, increased IoT and IIoT support is becoming more widespread among most MNS providers in this research.

- Microsegmentation implementation and operations support is growing within the MNS providers’ capabilities to implement and operate (via MNS). Implementations of this model are increasing in critical data infrastructures such as manufacturing, healthcare and utilities to restrict current exposures to east-west LAN traffic.

- Customer experience monitoring tools and approaches are expanding. There is a shift from the current datasets from tools’ analytics capabilities toward analyzing data and providing insights, leading to plans to achieve proactive monitoring across all user application sessions for anomaly detection. The goal is for MNS providers to capture live and real-time experience data, learn what’s normal (with higher frequency and fidelity than typically seen historically) and proactively avoid degradation or loss of service.

- The majority of providers continue to improve the breadth and depth of their security offerings while having enhanced alignment between MNS LAN/WAN and security. AI and ML continue to drive improvements across the breadth of MNS offers.

Accenture

Accenture is a Leader in this Magic Quadrant™. Its products are broadly focused on providing substantial transformations of customers’ IT operations across LAN, WAN and security. Its operations are geographically diversified, and its customers tend to be multinational organizations. It plans to continue to invest in its tools and its API integration strategy, which is focused on simplifying heterogeneous architectures. It will continue expanding its strategic partners in its solution enablement activities and joint go-to-market initiatives across all regions.

Strengths

- Solution orientation: Accenture’s MNS offering enables customers to establish and strengthen alignment across LAN, WAN and security.

- Extensible: Accenture’s MNS offerings extend options for private Long Term Evolution (LTE) and 5G network-enabled mobility use cases.

- Security differentiation: Accenture’s Secure Programmable Network offering expedites the deployment of multiple MNS services by providing automation within the vendor’s Cloud Network Operator (CNO) platform.

Cautions

- Integration gap: Accenture currently does not perform case management in IT service management (ITSM) systems, so it does not integrate with customer ITSM.

- Scope: Accenture has demonstrated diminished interest in narrow-scope MNS opportunities, such as single offer category opportunities with relatively narrow impact to achieving enterprise objectives.

- Security portfolio: Accenture’s NAC offering is less mature and behind some others in this research.

XTIUM (Formerly ATSG)

XTIUM, formerly ATSG, is a Leader in this Magic Quadrant™. XTIUM, formerly ATSG, owns the former MNS pure-play vendor Optanix. Its MNS offering delivers standardized, scalable and automated MNS for LAN, WAN and security. Its operations are geographically diversified, and its customers tend to be midsize to large enterprises located primarily in the U.S. and Europe. XTIUM, formerly ATSG, is increasing its investments in automation and predictive analytics, while extending its focus on private 5G market use cases.

Strengths

- Integrations: XTIUM, formerly ATSG continues to expand its wholly owned service delivery platform (SDP) capabilities with integrations to third-party AI platforms.

- End-user experience: XTIUM, formerly ATSG’s end-user experience monitoring for enterprise on-premises and cloud-based applications performance is in the top quartile, compared with others in this research.

- Security roadmap: With an emphasis on security orchestration, automation and response (SOAR), xSOAR and AI, XTIUM, formerly ATSG, has strong future plans for MNS security improvements.

Cautions

- Platform: The vendor offers a co-management option for enterprises that may create conflicts with its core MNS platform development priorities.

- Security portfolio: XTIUM, formerly ATSG’s threat detection and response capabilities are not as developed as the majority of its other service offerings.

- Brand awareness: Enterprise awareness of XTIUM, formerly ATSG’s brand is limited compared to other Leaders and has been further diminished by other similarly named entities.

AT&T

AT&T is a Niche Player in this Magic Quadrant™. Its managed LAN, WAN and security services are available across all industry segments and verticals globally with its highest concentration of customers in the U.S. and Europe. Its MNS delivery operations are geographically diversified, and its customers tend to be enterprise customers of all sizes, across all geographies and all industry segments. The vendor continues to work on improving its impact on the MNS market amid its competing core asset leverage strategy.

Strengths

- SD-WAN: AT&T supports leading SD-WAN vendors within its MNS for WAN services.

- Customer ITSM integration: AT&T’s MNS platform is integrated with a large number of end-user customers for case management exchange.

- Enhanced security: AT&T has demonstrated improvement in the areas of threat correlation and community collaboration, and introduced a no-code custom app builder within its open extended detection and response (XDR) platform USM Anywhere.

Cautions

- Operations and support: Some clients report that AT&T subcontracts the delivery of services contracted to other third-party MNS providers. Clients should confirm who is supporting and delivering the managed network services.

- Customer experience: AT&T’s MNS portal capabilities lag behind most others in this research.

- Security maturation: Reporting and SLAs on data integrity and availability within AT&T’s managed security services are underdeveloped.

Comcast Business

Comcast Business is a Niche Player in this Magic Quadrant™. This year, the vendor rebranded the Masergy assets it acquired three years ago to Comcast Business. Its managed LAN, WAN and security services focus on retail storefront-type WAN topologies. Its operations are focused primarily in the U.S., with a smaller number of international customer sites. Its customers tend to be enterprises across most industry segments and verticals. The vendor plans continued managed firewall enhancements in the near term.

Strengths

- Change management: Compared with other vendors in this research, Comcast Business delivers top-quartile cycle time performance for completing simple and complex move, add, change or delete (MACD) service requests.

- Pricing: Comcast Business’s MNS pricing is within the top quartile of attractiveness, when compared with others in this research.

- Security capabilities improvement: The vendor offers several options for applications and vendor integrations for its NAC solution.

Cautions

- Automation: Comcast Business’s incident automation performance lags most others in this research.

- SLA: Comcast Business’s SLA metrics for MNS are incomplete, compared with most others in this research.

- Security roadmap: Comcast does not plan to add security capabilities to its SD-WAN during the next 12 to 18 months.

HCITech

HCLTech is a Leader in this Magic Quadrant™. Its SDP is focused on consistent data quality, process efficiency and automation. Its operations are focused in the Americas and Europe, and its clients tend to be enterprises across most industry verticals. It plans to invest in GenAI integrations with SD-WAN to deliver complete automation for life cycle operations. It is building a vendor-focused GenAI large language model (LLM) as part of its SDP.

Strengths

- MNS: Customers report that HCLTech’s overall MNS capabilities are high-performing, compared with others in this research.

- LAN: The vendor has completed its planned microsegmentation support as a part of its focus on OT security use cases.

- MNS for security: HCLTech demonstrates strong key capabilities for MNS for security, including performance optimization, resilience and redundancy.

Cautions

- SD-WAN/SASE: HCLTech’s progress on achieving a multivendor unified policy model lags behind some leaders in this research.

- Pricing: HCLTech’s MNS pricing is higher than some leaders in this research.

- SWG strategy: HCLTech’s vision for enhancing secure web gateway (SWG) is minimal compared with competitors.

Hughes

Hughes (also known as Hughes Network Systems) is a Leader in this Magic Quadrant™. Its HughesON for MNS is focused on large retail and related verticals. Its operations delivery locations cover global regions including the Americas, Europe and Asia/Pacific (APAC), and its clients tend to be large enterprises, commonly with more than 150 sites. It is planning to expand self-installation capabilities for LAN and WAN devices within its SDP to reduce complexity and improve cycle time.

Strengths

- API: Hughes has added API integrations that incorporate business application visibility and alert fidelity to its customers’ help desk operations.

- Incident cycle time: Hughes deploys an active power distribution unit (PDU) that enables reduction of specific incident-detection cycle times to one minute.

- Security integration: Hughes’ managed NAC can integrate with an extensive number of vendors and applications.

Cautions

- SD-WAN: Hughes’ portfolio of market-leading SD-WAN OEMs is smaller than most other vendors in this research.

- Case management integrations: Most customers are not two-way integrated for case management from their internal ITSM tool with Hughes’ SDP.

- Security OS: Hughes lacks a programmatic approach for security OS management and maintenance.

Kyndryl

Kyndryl is a Niche Player in this Magic Quadrant™. Its MNS offers for LAN and WAN are broadly focused on large enterprises that require transformation of their IT operations. Its operations are geographically diversified, and its customers tend to be large enterprises across the Americas, Europe and APAC. Kyndryl’s focus on improving capabilities during the past 12 months has improved its overall MNS performance and strengthened its MNS brand awareness.

Strengths

- LAN: Kyndryl’s MNS for LAN endpoint coverage is more extensive than most others in this research.

- Portal: Kyndryl’s improved end-user portal provides customers with a uniform experience and ease of navigation.

- Security portfolio: Kyndryl is focused on improving capabilities for responding to new regulations and audits, while preparing customers for the next generation of threats.

Cautions

- Support and operations: Some clients report that Kyndryl often subcontracts the delivery of managed network services contracted to other third-party MNS providers. Clients should confirm who is supporting and delivering the managed services.

- Pricing: Kyndryl’s firewall pricing is among the highest of the vendors evaluated in this research.

- SD-WAN security: Kyndryl MNS offer for SD-WAN security is less complete than most others in this research.

Lumen

Lumen is a Niche Player in this Magic Quadrant™. Its MNS for LAN, WAN and security is focused on providing network product and services support across enterprise network estates. This complements the vendor’s primary focus on its network services business. Its operations are focused in Europe and the Americas, and its clients tend to be traditional MNS buyers that also purchase network services from Lumen. Its MNS focus includes retail, manufacturing, financial services, healthcare and the public sector segments.

Strengths

- Committed investments: Lumen’s MNS investments remain its focus, including services packaging, automation and customer experience (CX).

- SD-WAN: In the past year, Lumen added hosted gateway support for Versa and Fortinet.

- Digital transformation: Digital purchasing and provisioning is a plus for many down-market customers, and the integration of Rapid Threat Defense differentiates Lumen from some of its competitors.

Cautions

- MNS pricing: Lumen’s MNS pricing is higher than most other vendors evaluated in this research.

- Market understanding: Lumen lacks market-focused execution of its MNS platform capabilities by offering fragmented levels of support options across its MNS offers.

- Lack of NAC: Lumen does not provide NAC, focusing instead on zero-trust network access (ZTNA), which may not be suitable for all use cases.

MetTel

MetTel is a Leader in this Magic Quadrant™. Its range of MNS for LAN, WAN and security is applicable to all enterprises, using the same service management platform for managed LAN and WAN, with integrations for security. Its operations are mainly focused in the U.S., and its customers tend to be large enterprises and government entities located primarily in the U.S. and Europe. The vendor has expanded MNS delivery partnerships across federal and commercial market vendors, adding customers in an additional 35 countries during the past year.

Strengths

- Customer-centric SASE/SSE: MetTel provides a strong approach to rightsizing appropriate SSE or SASE implementations.

- Improved cycle time: MetTel added an automated PDU that reduces incident detection cycle time for LAN and WAN endpoints.

- Managed POTS transformation: MetTel has a large-scale digital transformation solution for managing and automating analog infrastructure life cycle extensibility.

Cautions

- Pricing: MetTel’s MNS pricing is higher than most other vendors evaluated in this research.

- Business application mapping: MetTel’s portal visibility scope does not include application-to-infrastructure service mapping.

- SD-WAN security operations: MetTel’s secure SD-WAN OEM vendors’ support options lag behind some others in this research.

Microland

Microland is a Leader in this Magic Quadrant™. Its MNS for LAN, WAN and security provide automation-enabled service delivery capabilities. It includes service mapping analytics, visibility and user experience (UX) for multiple endpoint types. Its customers tend to be midsize to large enterprises across all verticals and regions. During the next 12 months, Microland plans to increase focus on its AI-enabled service capabilities with unified and adaptive security models for SD-WAN and SASE.

Strengths

- Manufacturing: Microland is a leading performer in this research for factory MNS, including IT/OT/IIoT integration, microsegmentation and policy-based segmentation.

- Complete offers: Nearly all Microland customers procure all three of the vendor’s MNS offerings.

- Firewall capabilities: Microland added significant capabilities to its firewall offering, including AI, automated compliance and a reduction in provisioning time due to adopting a NetDevOps approach.

Cautions

- Market awareness: Microland’s brand awareness for MNS is relatively low among global enterprise buyers.

- Pricing: Microland’s MNS pricing overall is average, as compared with others in this research.

- Security processes: Microland’s maintenance of the security OS processes are lacking discipline with change management.

NTT DATA

NTT DATA is a Leader in this Magic Quadrant™. Its MNS for LAN, WAN and security is focused on enabling clients to transform their networks with software-defined capabilities. Its operations are geographically distributed, and its clients tend to be large enterprises across all verticals. It plans to continue investments in GenAI to enhance self-service reporting, analytics and operations capabilities, while expanding its API gateway support for more log and telemetry data sources.

Strengths

- Pricing: NTT DATA customers report high satisfaction with the vendor’s pricing for MNS.

- Upgraded SDP: NTT DATA has delivered improved customer outcomes across cycle time performance and portal visibility during the past 12 to 18 months.

- Security: NTT DATA rapid detection, response and remediation via threat- and incident-specific playbooks.

Cautions

- Responsiveness: NTT DATA’s incident response cycle time is longer than most others in this research.

- Customized to standardized MNS migrations: Enterprises that are aligning their services to NTT DATA’s standardization of MNS delivery should govern closely to ensure that quality is maintained.

- NAC integration: NTT DATA has minimal application integrations available for NAC.

Presidio

Presidio is a Niche Player in this Magic Quadrant™. Its globally available MNS for LAN, WAN and security is focused on fulfilling OEM product sourcing, design, implementation and MNS for its clients to meet buyers’ network life cycle requirements. Its operations are geographically distributed, and its customers tend to be midsize enterprises spanning most industries, with the majority in the Americas and the rest in Europe and the APAC region. Presidio continues to develop its automation capabilities to improve customer experience across cycle time and service quality.

Strengths

- Portal: To deliver a unified experience, Presidio is improving its portal features, navigation and reporting for customers.

- Life cycle provider: Customers value Presidio for its ability to partner with them across their enterprise networking and security life cycles.

- Security controls: NAC and ZTNA operations for mixed environments are a key differentiator.

Cautions

- Integrations: Presidio’s customer integrations to its ITSM platform for case management and configuration management database (CMDB) continue to lag behind other vendors evaluated in this research.

- Pricing: Presidio’s MNS pricing is among the highest, compared with others in this research.

- Security approach: Presidio’s overall security approach is less comprehensive in both vision and execution and, therefore, is lacking compared with competitors.

Sify Technologies

Sify Technologies is a Niche Player in this Magic Quadrant™. Its MNS for LAN, WAN and security is focused on network service provider (NSP)-agnostic MNS. Its operations are focused primarily in the APAC region, where more than 90% of its customer sites are located. During the next 12 to 18 months, Sify plans to invest in expanding its presence in the banking, financial services and insurance (BFSI) and manufacturing sectors. Its incident classification data management discipline and accuracy investments have increased its overall service delivery quality year over year. It also plans to invest in multivendor SD-WAN orchestration capabilities.

Strengths

- OEM expansion: Sify Technologies is enabling unified management for Cisco SD-WAN and SD Access support capabilities.

- Portal: Sify Technologies is investing in a more integrated and navigable view of service status, performance reports and service request management.

- Security offerings: Sify Technologies provides consistent performance across security categories, with availability management and data integrity management specifically cited as better than most others in this research.

Cautions

- Automation: Sify Technologies’ performance with first contact resolution (FCR)-automated incident resolution lags behind other vendors evaluated in this research.

- Pricing: Sify Technologies’ market prices for MNS do not align with downward trends in the market, especially for firewall management.

- NAC integrations: Sify Technologies does not enable integrations of security tools into its NAC environment.

Systal

Systal is a Niche Player in this Magic Quadrant™. Its MNS for LAN, WAN and security is focused on NSP-agnostic MNS buyers. Its operations are located primarily in Europe, and its customers tend to be large enterprises across a variety of verticals; most are MNS for LAN clients. During the next 12 to 18 months, Systal plans to increase its support for automated self-service and automated, simple standard change requests.

Strengths

- Portal: Systal’s MNS end-user portal provides a simple ease of navigation experience for its customers.

- Integrations: The number of SDP integrations with customers’ ITSM that Systal provides is among the highest of vendors evaluated in this research.

- Security: Systal’s managed secure SD-WAN capabilities exceed most others in this research.

Cautions

- Limited geographic focus: Systal’s customer base is primarily in Europe and most purchase MNS for LAN.

- Automation: Systal’s zero-touch incident management network automation FCR performance lags compared to others evaluated in this research.

- Availability management: The vendor’s availability management execution lags behind in its vision because it relies primarily on integration with ITSM reporting.

TCS

Tata Consultancy Services (TCS) is a Challenger in this Magic Quadrant™. Its managed LAN and WAN services are focused on delivering MNS in close collaboration with regional and global network service providers (NSPs). Its operations are focused mostly in the Americas and Europe, with a smaller presence in APAC, and its customers tend to be midsize to large enterprises across most industry segments and verticals. The vendor’s SDP transformation has improved automation and service delivery quality across MNS for LAN, WAN and security.

Strengths

- Pricing: TCS’ pricing for enterprise buyers is lower than most providers in this research.

- Predictive analytics: TCS’ MNS for LAN predictive analytics increases the vendor’s proactive operations performance and capacity-tuning insights, resulting in higher preincident remediation.

- SD-WAN security: TCS provides strong SD-WAN security execution overall.

Cautions

- SD-WAN: TCS’ capabilities across managed SD-WAN assurance-focused service elements lags some others in this research.

- Incident classification: TCS’ “before” and “after” incident classification lacks granular specificity, which hinders continual service improvement automations.

- MNS for security: SD-WAN security execution progress in MNS for security is lagging behind many others in this research.

Telefónica

Telefónica is a Niche Player in this Magic Quadrant™. Its range of MNS for LAN and WAN is focused on partnering with NSPs with its MNS offerings. Its operations are globally diversified, and its clients tend to be small- to midsize businesses and large-enterprise customers seeking combined network transport and MNS. Investments in improving its enterprise end-user experience focus have strengthened the vendor’s service delivery platform during the past 12 months, yielding positive service quality and assurance capability improvements.

Strengths

- Pricing: Telefónica customers’ satisfaction with pricing ranks among the highest of the vendors evaluated in this research.

- Service mapping: Telefónica provides an integrated network and security portal experience that includes application service mapping to infrastructure elements.

- SD-WAN security: Telefónica’s SD-WAN embedded security includes SD-WAN segmentation over a single overlay.

Cautions

- Automation: Telefónica’s incident resolution performance is lower than most others in this research.

- SD-WAN support: Telefónica’s quantity of leading OEM support for SD-WAN is lagging most other vendors in this research.

- Security operations: Security OS management and maintenance lacks comprehensiveness, because it focuses primarily on server patching.

Wipro

Wipro is a Leader in this Magic Quadrant™. Its MNS for LAN, WAN and security focuses on service delivery, automation and customer satisfaction. Its operations are geographically diversified, and its clients tend to be large global enterprises. Wipro plans to invest in carrier-neutral SD-WAN solutions to help customers source connectivity options and enhance their multicloud network integration performance.

Strengths

- Continual service improvement: Wipro engages directly with customers through a customer collaboration portal to increase the speed of capability delivery.

- Incident response: Wipro’s FCR performance ranks favorably among other Leaders in this research.

- NAC: Wipro offers a complete NAC offering with advanced integration capabilities.

Cautions

- Automation progress: Wipro’s year-over-year automation performance improvements continue to lag behind the other Leaders in this research.

- Onboarding: Wipro customer reports of slow onboarding cycle times after contract execution persist. This can challenge commitments to business stakeholders.

- Firewall security: Wipro’s added firewall capabilities are minimal and focused on services, rather than firewall capabilities.

Industry-recognized and certified to support your IT needs

Trusted by 1,700+ mid-size and enterprise companies, we operate as an extension of your team—solving problems with urgency and accountability so you can focus on strategy, not firefighting. We are not just another MSP. We're your force multiplier that bring proven frameworks and real-world experience to help you secure, scale and streamline operations with fewer resources. Stop juggling vendors. Stop fighting uphill battles. Work with an IT partner who gets IT.